Klarna at World Extreme Medicine

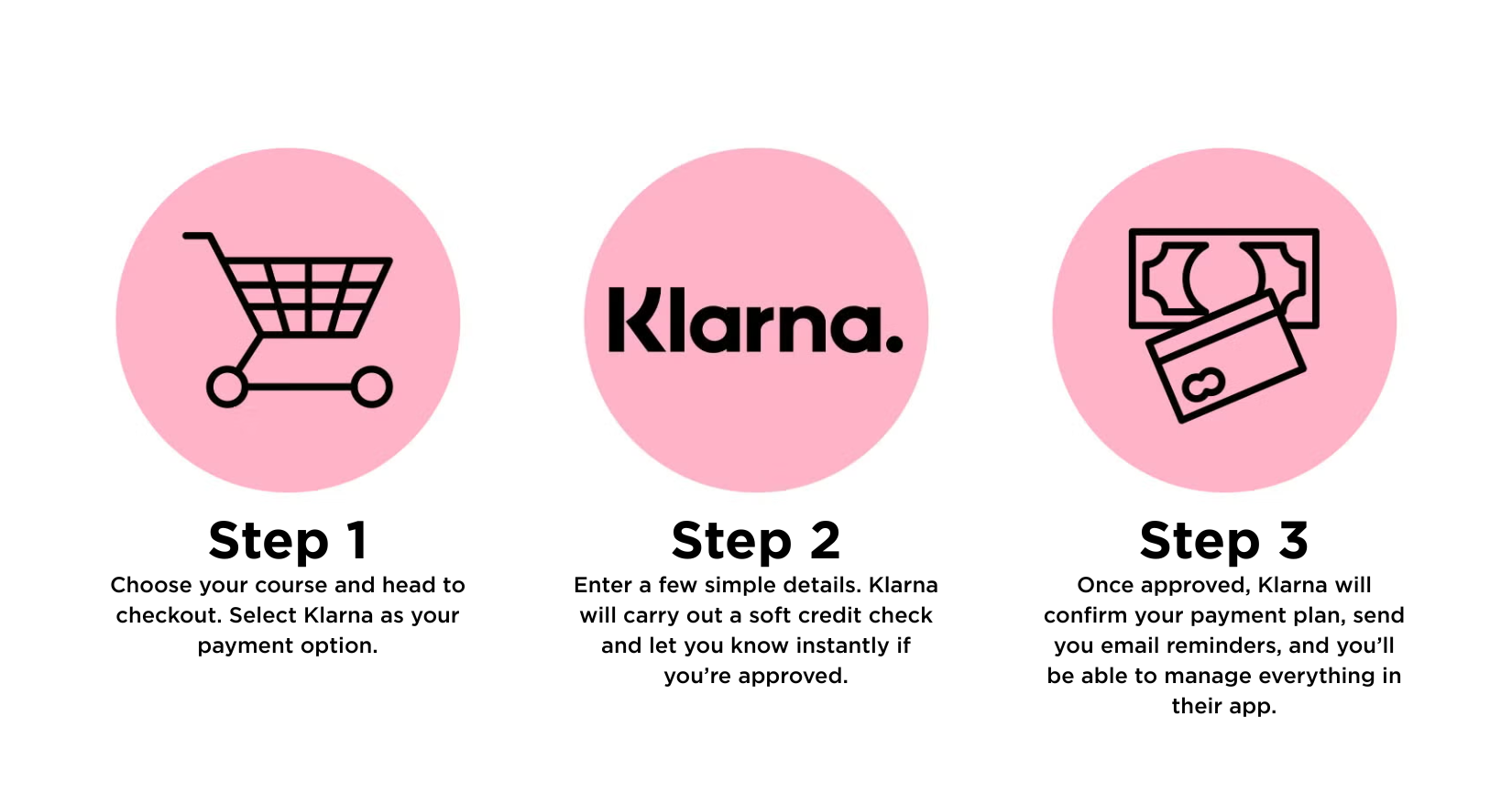

How it works

Important info

Klarna’s Pay in 3, Pay in 30 Days. Borrowing more than you can afford, or missing payments, may negatively impact your financial status and access to future credit. Klarna may report missed payments to credit reference agencies. Always budget carefully and only commit to a plan you’re confident in repaying.

For full Klarna terms and conditions, visit: www.klarna.com/uk/terms-and-conditions

FAQ

What is Klarna?

Klarna is a global payment service that gives you more flexibility at checkout. It allows you to book now and pay later in a way that suits your budget, whether that’s in 30 days, or over 3 instalments.

How do I use Klarna on the WEM website?

-

Choose your course and head to checkout

-

Select Klarna as your payment method

-

Enter a few personal details

-

Klarna will do a quick soft credit check and let you know if you’re approved

-

Confirm your payment plan and you’re good to go

You’ll get a confirmation email from Klarna and can manage your payments in their app or online portal.

Is Klarna interest-free?

Yes, for Pay in 3 and Pay in 30 Days, there’s no interest or additional fees as long as you pay on time. Interest may apply depending on your eligibility and plan. Klarna will show you any interest before you confirm.

Am I eligible to use Klarna?

To use Klarna, you must:

-

Be 18 years or older

-

Live in the United Kingdom or in a Klarna supported country ((UK, EU, US, Canada, Australia, New Zealand)

-

Use a valid debit or credit card

-

Pass Klarna’s soft credit check (this won’t affect your credit score)

Final approval is based on your personal financial status and Klarna’s checks.

Can I use Klarna if I live outside the UK?

Absolutely! Klarna offers a *Pay Now* checkout option worldwide, so you can book your WEM course and pay upfront even outside the UK and core BNPL markets.

However, interest-free instalment options like Pay in 3 and Pay in 30 Days are only available to customers in supported countries (UK, EU, US, Canada, Australia, New Zealand).

If you’re outside those regions, you’ll still see Klarna as a payment option, just the full upfront payment method.

What if I miss a payment?

Klarna will send you reminders before a payment is due. If you miss a payment:

-

Klarna may retry the payment

-

You may be charged a late fee (on some plans)

-

Repeated missed payments can affect your ability to use Klarna in future

-

Klarna may refer your account to debt collection as a last resort

If you’re struggling, Klarna encourages you to contact them directly: www.klarna.com/uk/customer-service

Can I pay off a Klarna plan early?

Yes – log into your Klarna account online or in the app to make an early payment, pay off the full balance, or update your card details at any time.

How do I manage my Klarna account?

Klarna’s Pay in 3, Pay in 30 Days, and long-term financing are all forms of credit. Borrowing more than you can afford, or missing payments, may negatively impact your financial status and access to future credit. Klarna may report missed payments to credit reference agencies. Always budget carefully and only commit to a plan you’re confident in repaying.

For full Klarna terms and conditions, visit: www.klarna.com/uk/terms-and-conditions